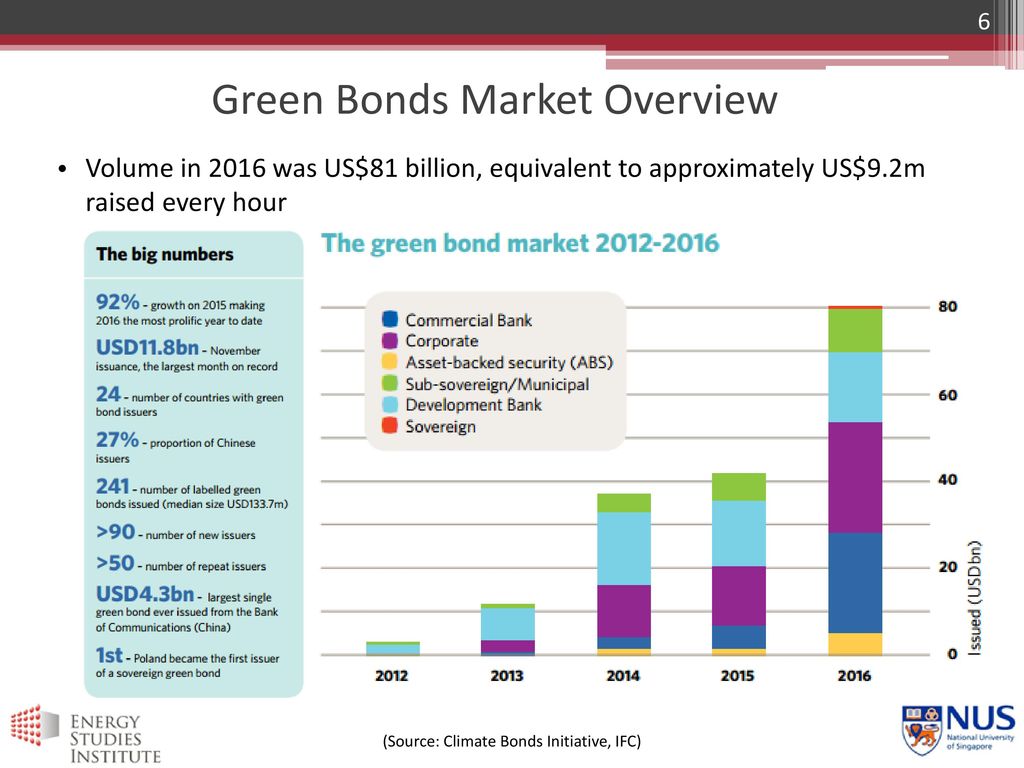

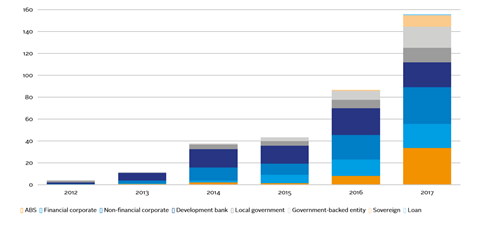

Climate Bonds launches Green bonds: The state of the market 2018 report at London Annual Conference | Climate Bonds Initiative

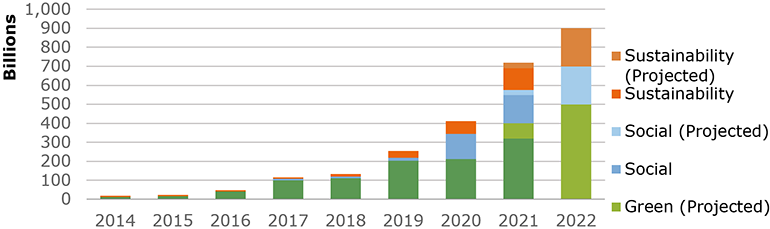

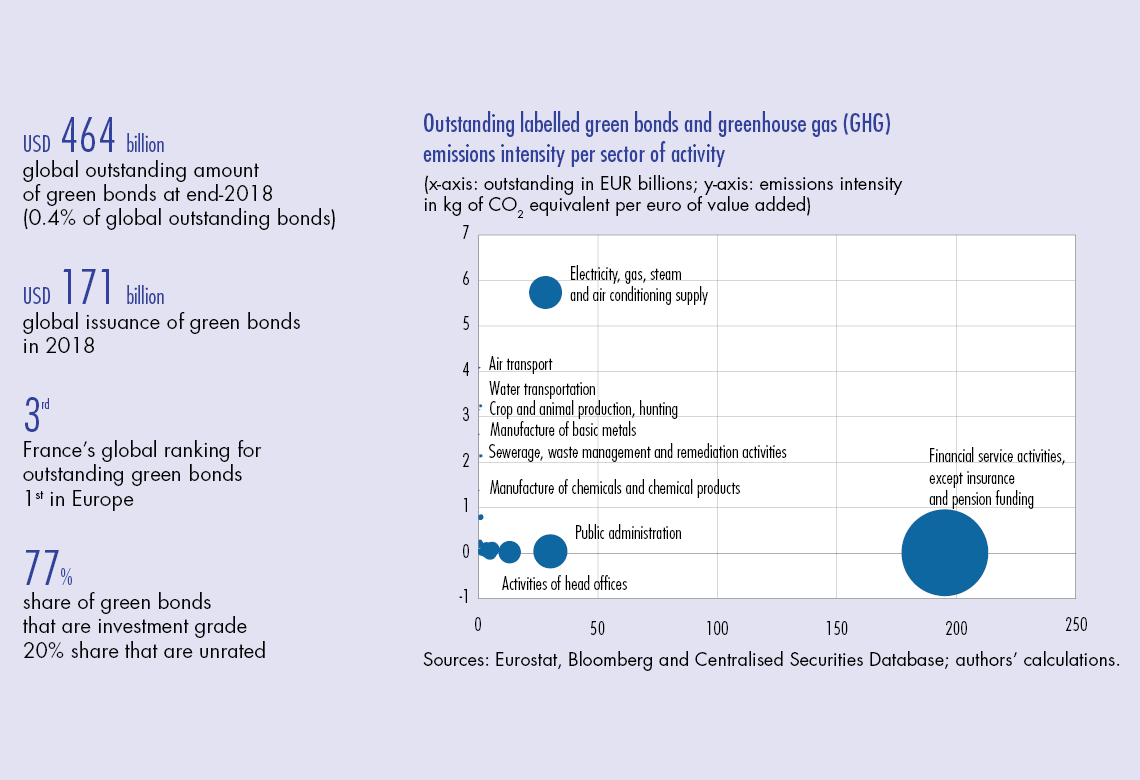

The green bond market is expanding rapidly but needs to be measured more accurately | Banque de France

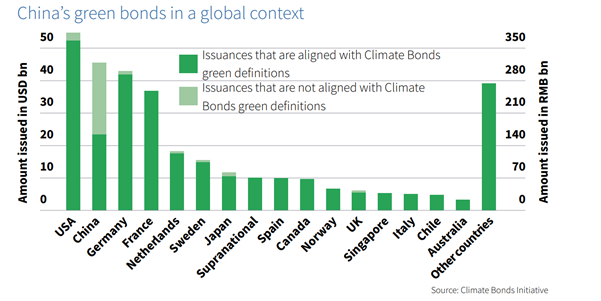

Climate Bonds on Twitter: "Highlights from our new China #GreenBonds Report 2019. Of USD55.8bn (RMB386.2bn) worth of green bonds issued in 2019, USD31.3bn (RMB216.8bn) worth was aligned with both Chinese & CBI

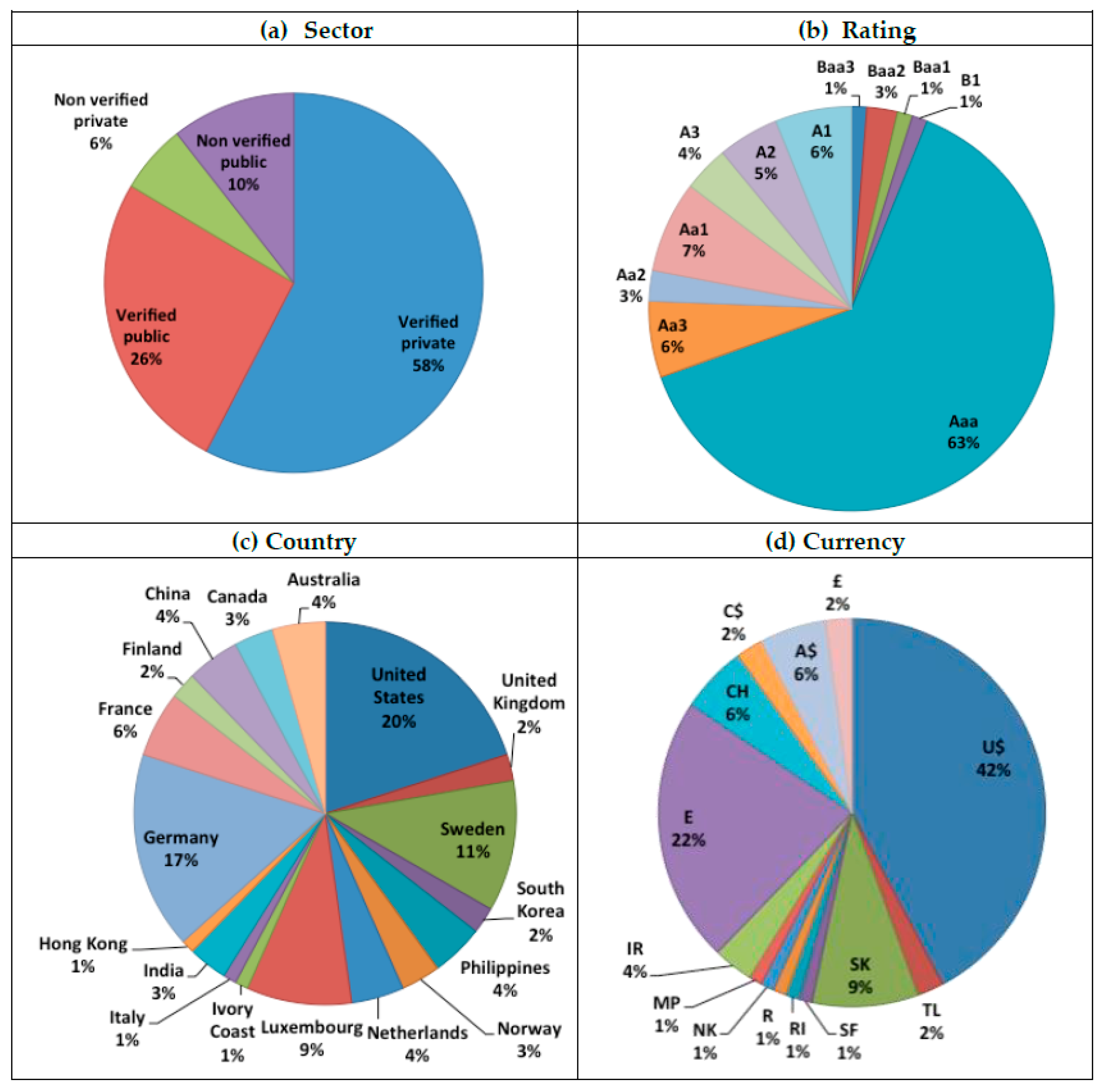

Sustainability | Free Full-Text | The Green Bonds Premium Puzzle: The Role of Issuer Characteristics and Third-Party Verification | HTML

China totalled USD44bn in labelled green bonds during 2020: Second largest country for green issuance | Climate Bonds Initiative

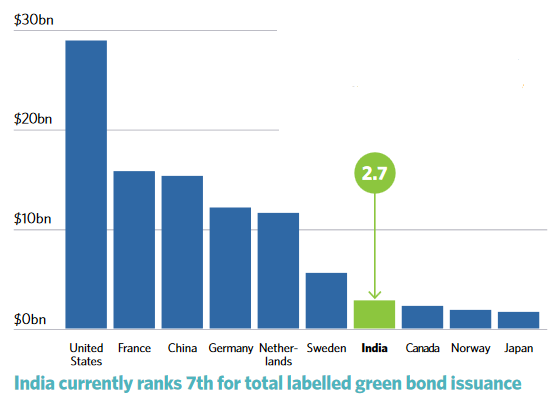

Green bonds: India becomes second-largest market for Green Bonds with $10.3 billion transactions, Energy News, ET EnergyWorld