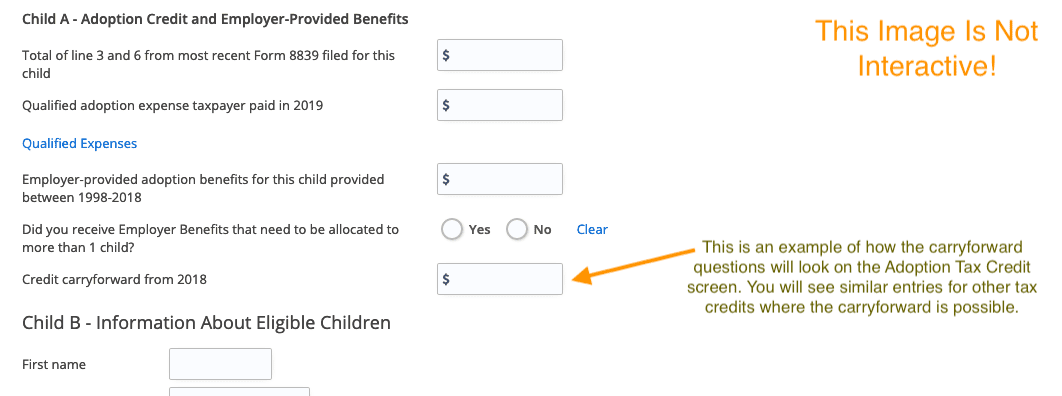

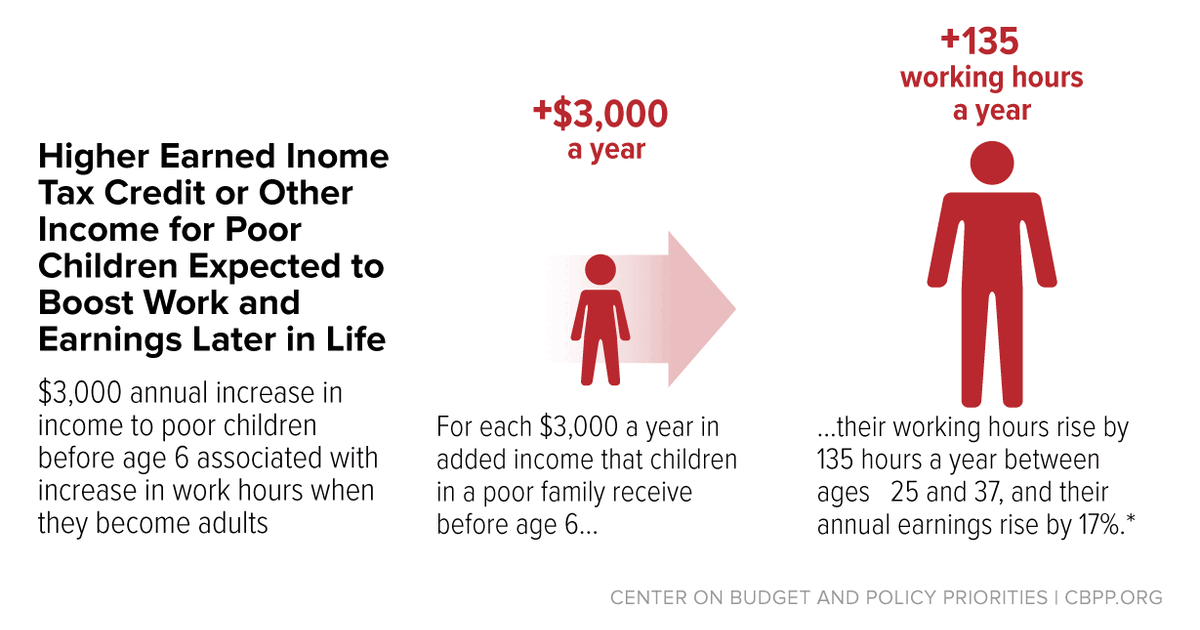

EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children's Development, Research Finds | Center on Budget and Policy Priorities

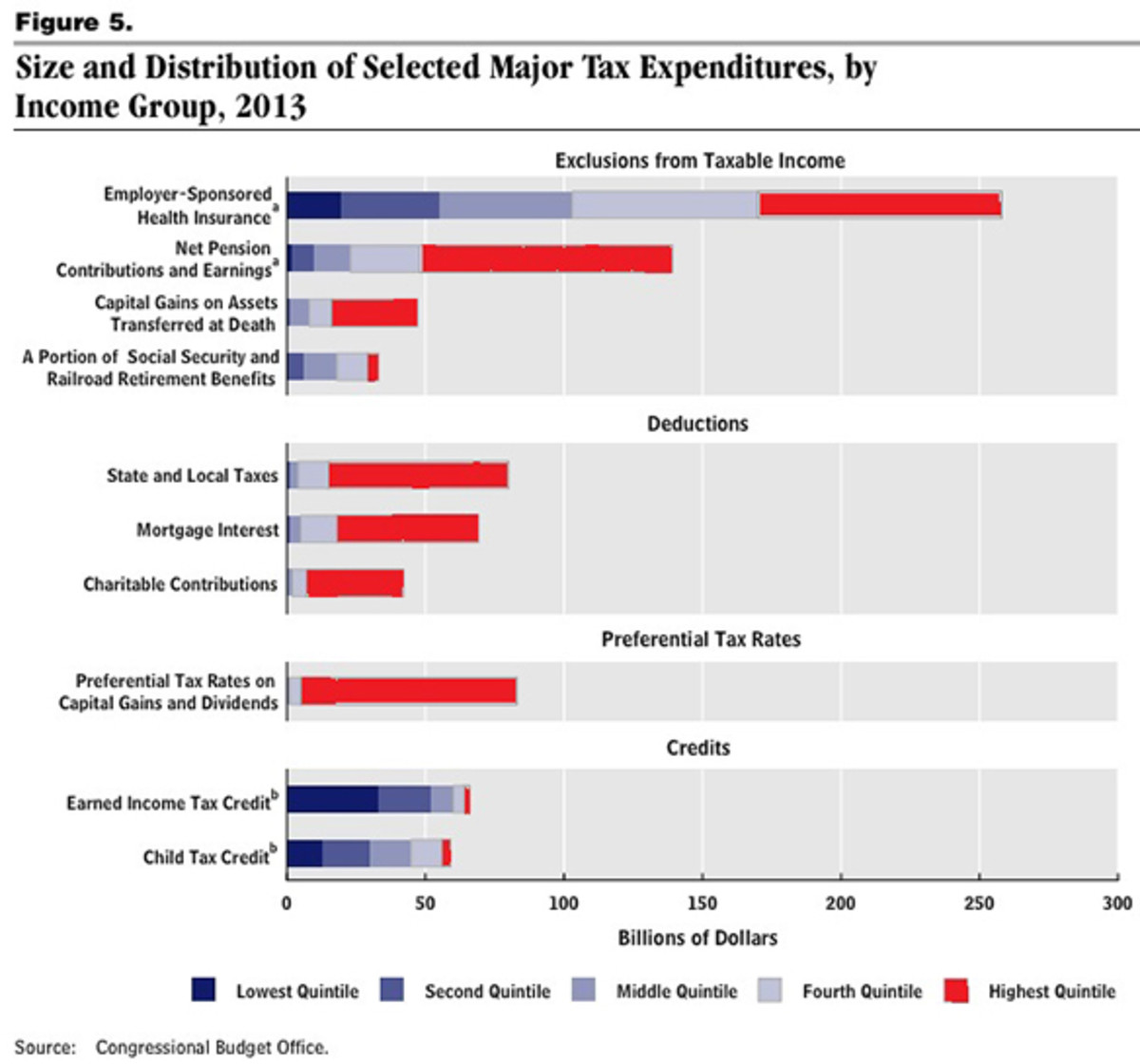

Substantial Income of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks | Center on Budget and Policy Priorities

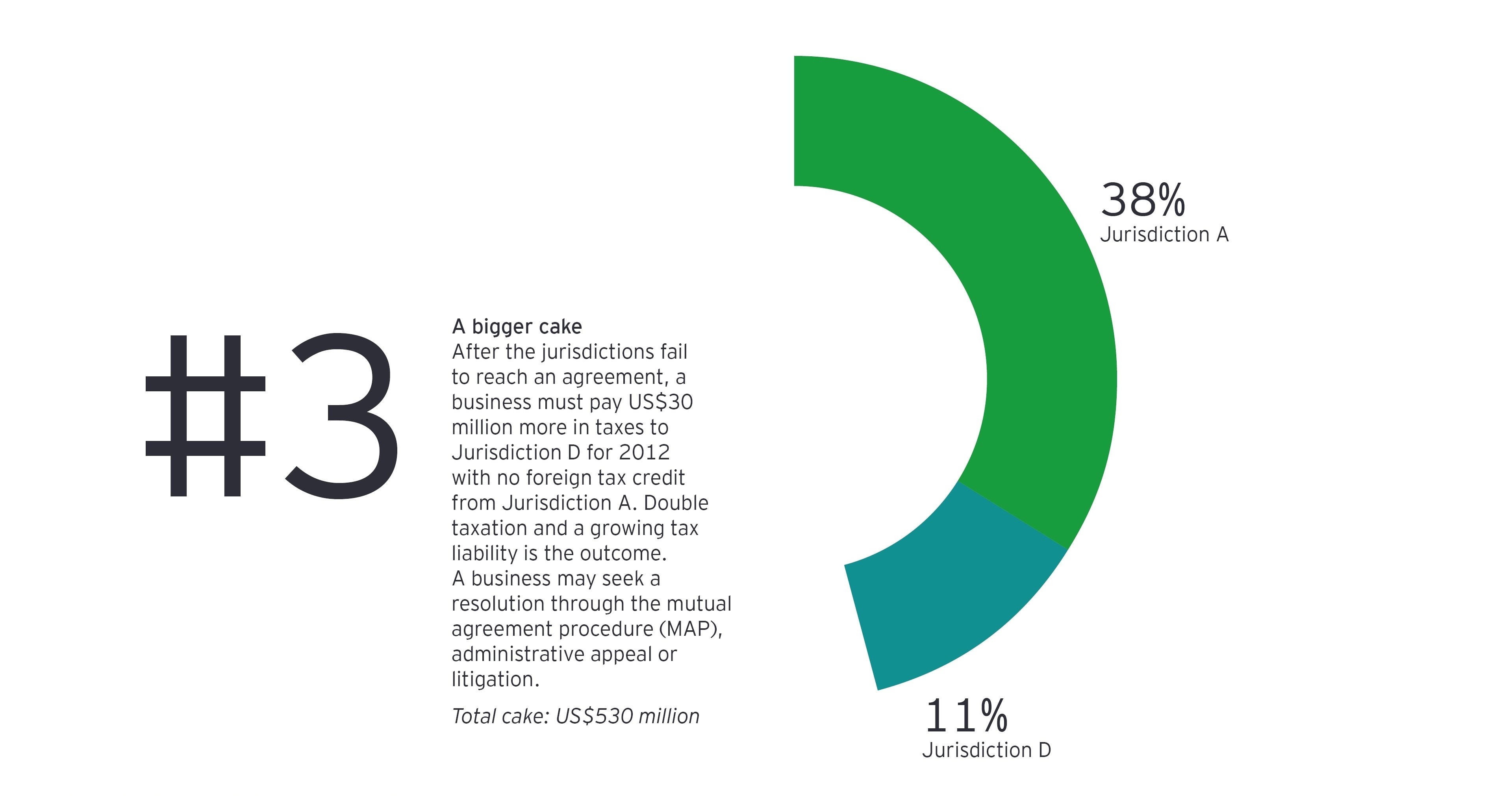

International Taxation: Debt Financing, Taxation and Transfer Pricing By Koy Saechao. - ppt download

:max_bytes(150000):strip_icc()/dotdash_Final_Net_of_Tax_Dec_2020-98efd407350341fdb178949dadd84c5c.jpg)