Risks | Free Full-Text | Insolvency Risk and Value Maximization: A Convergence between Financial Management and Risk Management | HTML

Risks | Free Full-Text | Insolvency Risk and Value Maximization: A Convergence between Financial Management and Risk Management | HTML

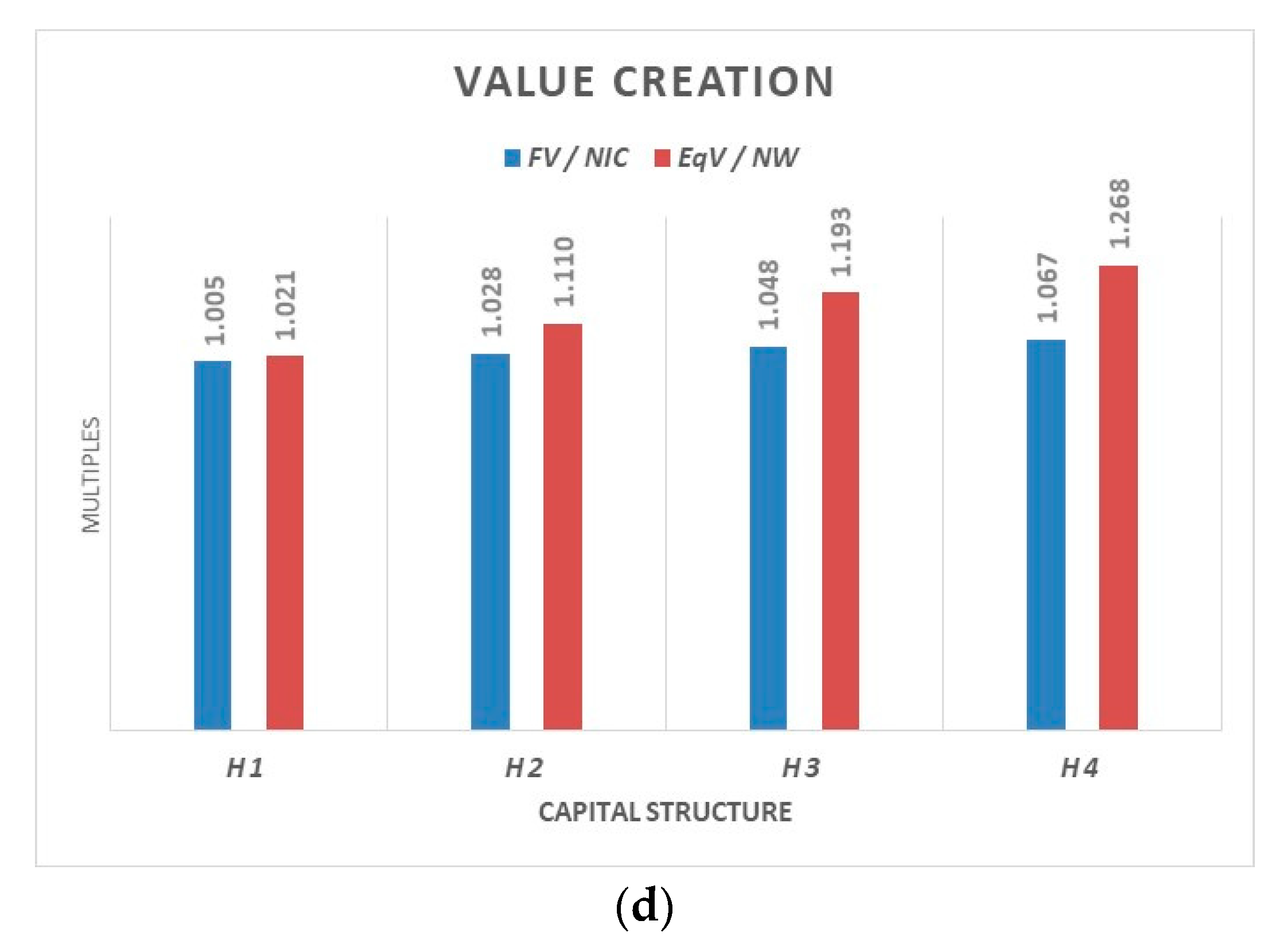

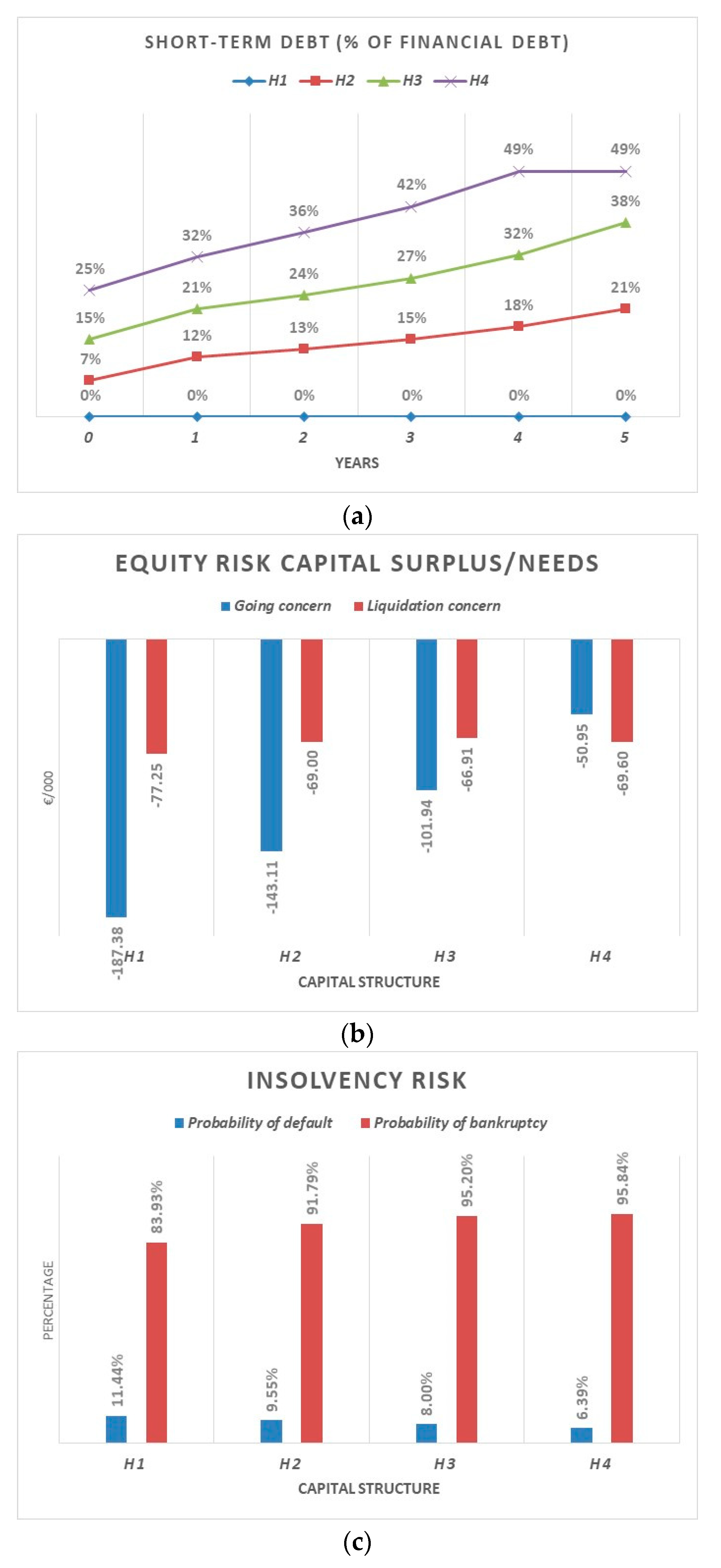

Third simulation: dynamics of capital structure, risk and value: (a)... | Download Scientific Diagram

/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

![Risk category based on the short period [21] | Download Scientific Diagram Risk category based on the short period [21] | Download Scientific Diagram](https://www.researchgate.net/publication/342867649/figure/tbl2/AS:912092043419648@1594471097257/Risk-category-based-on-the-short-period-21.png)

/GettyImages-1054017850-b65a3cabcbd54612a75bd822540f778d.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)